I abhor averages… A man may have six meals one day and none the next, making an average of three meals per day, but that is not a good way to live.Louis D. Brandeis, Supreme Court Justice

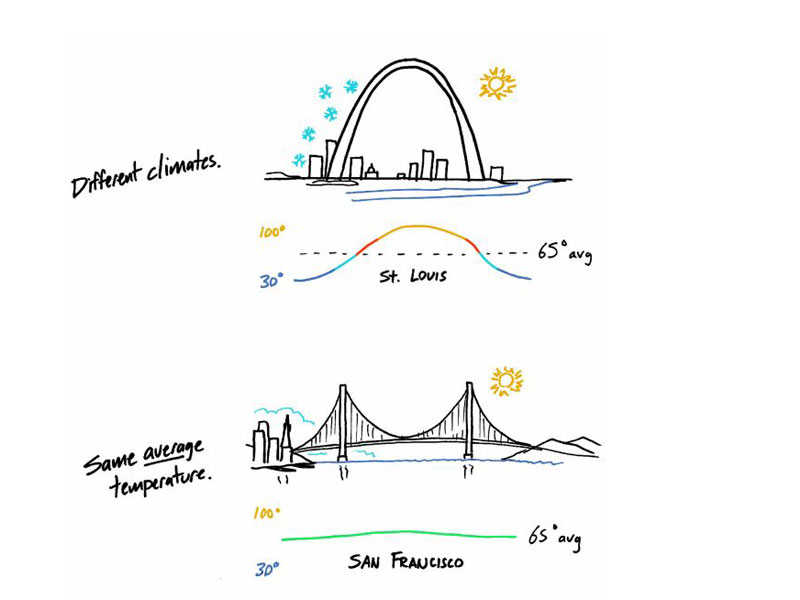

You are looking to retire somewhere with a mild climate. So you do a little research and find two cities that have an annual average temperature of about 65 degrees: San Francisco and St. Louis.

But then you do a little more research and find that while San Francisco is pretty much 65 degrees most of the year, St. Louis has hot summers and cold winters — something you would never know just looking at the averages. Similarly, many investors make the mistake of focusing only on a average rates of return — sometimes with disastrous consequences.

Consider the S&P 500. Over the last nine decades, it has had up years and down years, but there was just a handful of years where the annual return came close to the average return. And this can be challenging for some investors to handle.

This is why it makes sense to work with a financial advisor who uses tools that account for variability in returns. Good planning is an ongoing and dynamic process between you and your advisor, which helps to minimize uncertainty and maximize your potential for future success.