It is a rough road that leads to the heights of greatness.Seneca, Philosopher

Imagine there was electronic sign on your home that always showed its latest price, or that you logged in to Zillow every day to check your home’s valuation. If your home dropped in value by 15%, would you immediately sell it?

Probably not. Our house has a necessary functional value — even if the price goes down, we still need a place to live. The same may be true for investing. Its necessary functional value is to help us achieve our most important goals: educating kids, staying ahead of inflation, enjoying a long and secure retirement.

When markets are open, stock prices change every second. Though markets have historically gone up over the long term, in the shorter term, prices can swing wildly and even decline severely.

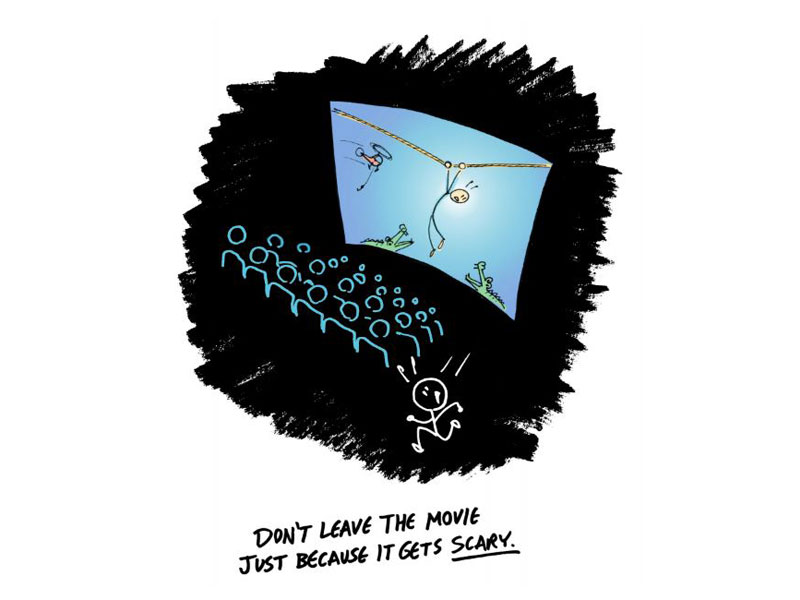

This can lead some investors to panic and sell, turning a temporary decline into a permanent loss (since you no longer own the investments and can’t benefit from any future rebound). It is a little like leaving a great movie just because there is a scary scene in the middle.

So the next time your portfolio value drops, ask yourself if it’s worth creating a permanent loss or whether your reasons for investing in the first place (i.e., retirement) still apply.