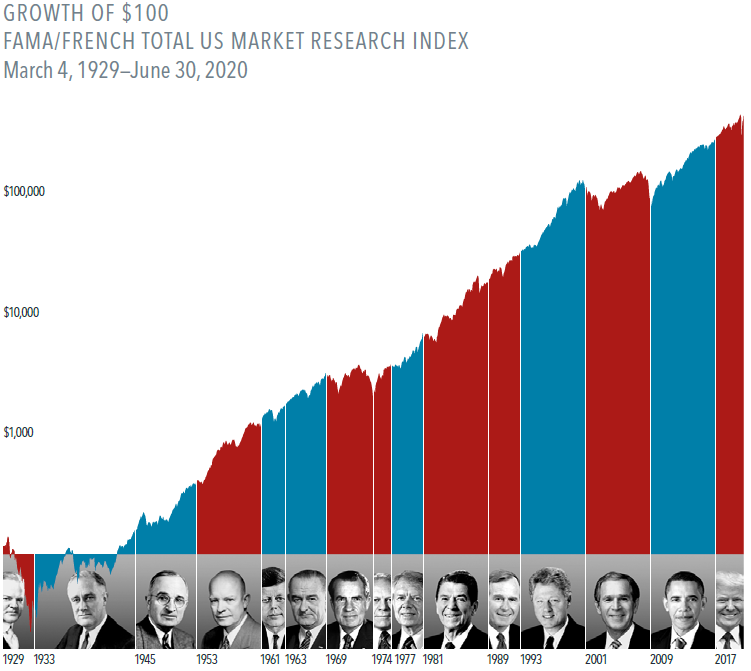

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. But as nearly a century of returns shows, stocks have trended upward across administrations from both parties.

- Shareholders are investing in companies, not a political party. And companies focus on serving their customers and growing their businesses, regardless of who is in the White House.

- US presidents may have an impact on market returns, but so do hundreds, if not thousands, of other factors—the actions of foreign leaders, a global pandemic, interest rate changes, rising and falling oil prices, and technological advances, just to name a few.

Stocks have rewarded disciplined investors for decades, through Democratic and Republican presidencies. It’s an important lesson on the benefits of a long-term investment approach.

If you’re interested in more information, see How Much Impact Does the President Have on Stocks for the detailed version.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.In US dollars. Growth of wealth shows the growth of a hypothetical investment of $100 in the securities in the Fama/French US Total Market Research Index. The chart begins with the start of the first full presidential term (March 4, 1929) for which Fama/French Total US Market Research Index data is available and ends on June 30, 2020. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

Fama/French Total US Market Research Index: This value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.