The Neverending Pursuit of Money

What would it be like to be ultra-wealthy? Would it mean homes in Hawaii and Paris? Do you envision sailing

What would it be like to be ultra-wealthy? Would it mean homes in Hawaii and Paris? Do you envision sailing

Technology has helped streamline how we manage our money, allowing us to perform transactions and monitor our accounts online, instead

Prepare for the upcoming tax season by reviewing 2024 inflation adjustments, important deadlines, and opportunities to minimize your tax bill.

When can you access your savings without a penalty? When should you enroll in Medicare? At what age is it

As we navigate the digital landscape, we must be aware of the evolving fraud risks posed by Artificial Intelligence (AI).

While we often talk about the financial aspects of retirement, it’s equally important to consider the emotional, mental, and physical

Did you know that 40% of workers today plan to move to a different city or region after they retire?[1]

Making financial decisions can often be more challenging than it appears. A variety of subtle influences, like anchoring, loss aversion,

Dividend stocks are popular with investors due to their regular cash flow and perceived lower risk. But are they a

How much can you spend in retirement without depleting your assets? Not long ago, individual retirement accounts (IRAs) required minimum

When we hear the term “gratitude,” most of us think of living a happier and more fulfilling life. We think

It’s a fair question to ask ourselves: Should my investment portfolio be exposed to foreign companies? The answer is nuanced

As you likely know, both Silicon Valley Bank (SIVB) and New York-based Signature Bank (SBNY) were shut down by regulators.

2022 was a rocky year for markets. These 10 investment lessons show that sticking to a well-thought-out plan remains the

Safety first! It’s easy to say but sometimes hard to do when we’re caught up in our busy lives.

If you’ve inherited an IRA recently, here’s what you need to know about planning distributions and keeping up with changing

Social Security benefits will go up 8.7% in 2023, the largest adjustment in four decades. Here’s why you don’t need

Although the recent volatility can be unnerving, it’s important to remember that it is impossible to accurately predict changes in

Most investors have a process for deciding which investments to buy in their portfolio with different objectives for building wealth

While there’s always uncertainty in the outlook for the economy and financial markets, a confluence of events has pushed the

A concentrated position in a single stock can happen to investors for many reasons. They may receive company stock as

After a strong global rebound following the market downturn associated with the onset of the COVID-19 pandemic, both stock and

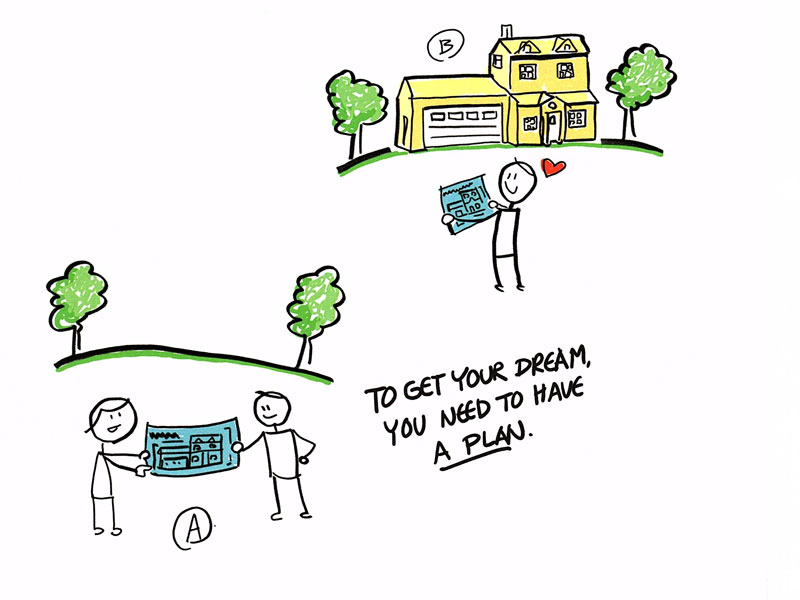

What? Benjamin Franklin once said: If you fail to plan, you are planning to fail. Inversely to succeed, a proper

Midterm elections are just a few months away. This can mean only one thing … a flurry of political ads

As you’re finishing up your 2021 tax return, you may be thinking your tax work is done until next spring.

As we awoke last month, we learned that Russia launched a large-scale invasion of Ukraine—one of the most significant geopolitical

With the recent uptick in market volatility and the poor start to the year for the U.S. stock market, I

We’ve all said it…“I’ll start on January 1.” Whether it’s hitting the gym or eating more vegetables, every year millions

As the days get shorter and our to-do lists seem to get longer, it is easy to become overwhelmed with

Investing in the Face of Uncertainty By Daniel Campbell, CFA “Risk is what’s left over after you think you’ve thought

Each year, the period between Labor Day and New Year’s Day can feel like a full-on sprint. And I’m not

Remember when you were in school and had to cram hundreds of pages from a textbook (or two) into your

When we’re under stress, most of us are inclined to focus on near-term risk and reward, a phenomenon called temporal

Seth Godin recently raised the concept of insignificant digits. He writes, “Who’s a better student? The one with a 3.95

You notice that a competitor always opens a game with the same move. When it comes time to face each

You’re probably quite familiar with the pictograms in our public spaces – the areas in which we tend to gather,

How to compare plans based on your specific needs The basic premise behind life insurance is simple: You pay premiums

When you’re in a traffic jam on the highway, you may find yourself trying to merge into whichever lane is

How we can help you manage your taxes this year Reducing your tax burden can help you manage your wealth

Charitable giving is a great way to support the causes you care about while also getting a tax break. In

Manage cash flow in retirement with multiple income streams When you retire, you get to bid farewell to the working

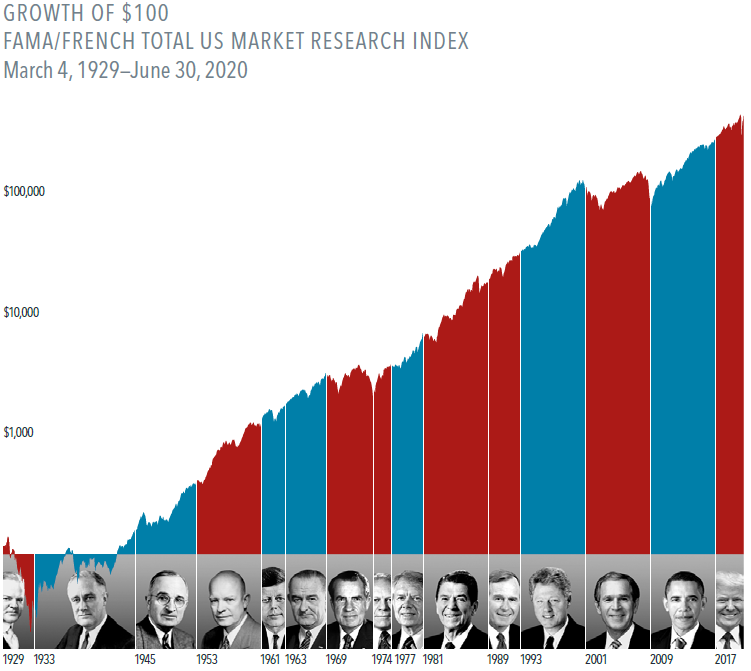

Elections can move the market, but that doesn’t mean you should change your approach Like any big news event, U.S.

It’s natural for investors to look for a connection between who wins the White House and which way stocks will

A recent New York Times article discussed the stock market impact of Joe Biden winning the 2020 presidential election. The

These best practices can help you stay invested during the market’s ups and down The COVID-19 pandemic helped put an

Your IRA and Your Legacy Individual retirement accounts can play a valuable role in the estate planning process Individual retirement

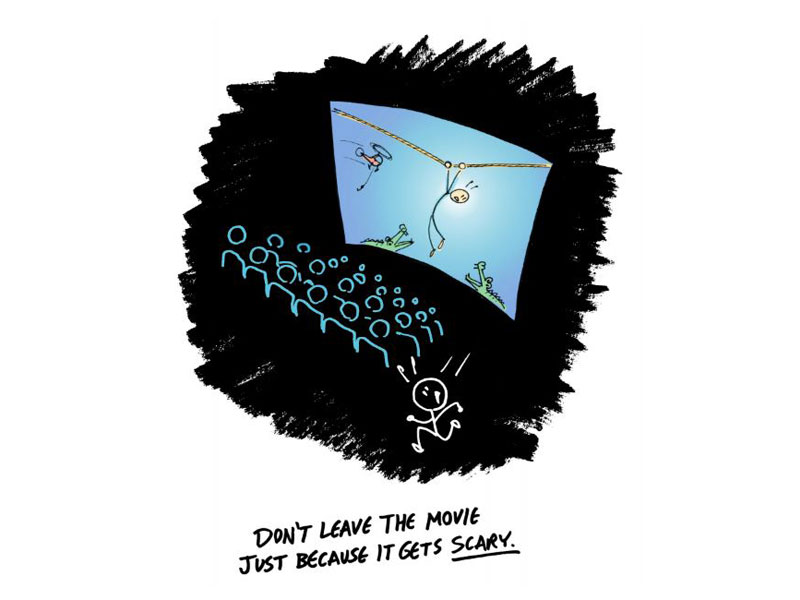

Fear, uncertainty, volatility, panic—these emotions are nothing new to the world of investing. In fact, they seem to reappear on

When stock markets experience sudden downturns, investors can feel anxious and make decisions detrimental to their long-term goals. After all,

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with

On December 20th, 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act became law. As the name implies,

Making a New Year’s resolution is the first step to creating better habits. But making a New Year’s resolution and

Are your finances ready for the end of the year? December brings many deadlines and lists; there are gifts to

The increasing cost of higher education saddles many young adults with massive amounts of student debt. This student debt makes

Be Prepared: 7 Estate Planning Tips No financial plan is complete without an estate plan. Estate planning covers all aspects

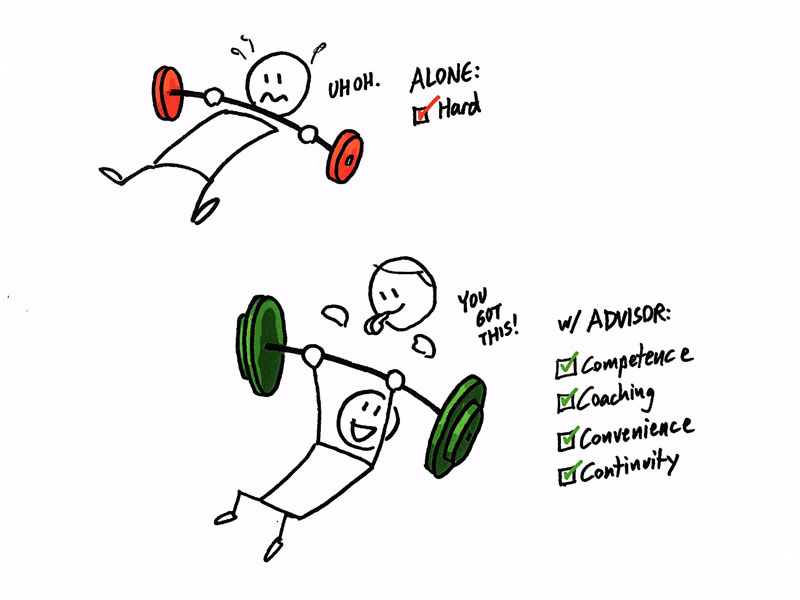

1) To Reduce Complexity. While there’s a virtually never-ending availability of information on the internet, having the information doesn’t mean consumers know what to do with it

Very few investors manage to beat the market. But in an astonishing triumph of hope over experience, millions of investors

[T]hose whoe disagree with market efficiency simply assert that it stands to common sense that greater effort to get facts

If you fail to plan, you are planning to fail. Benjamin Franklin, Founding Father Many think investing is simply about

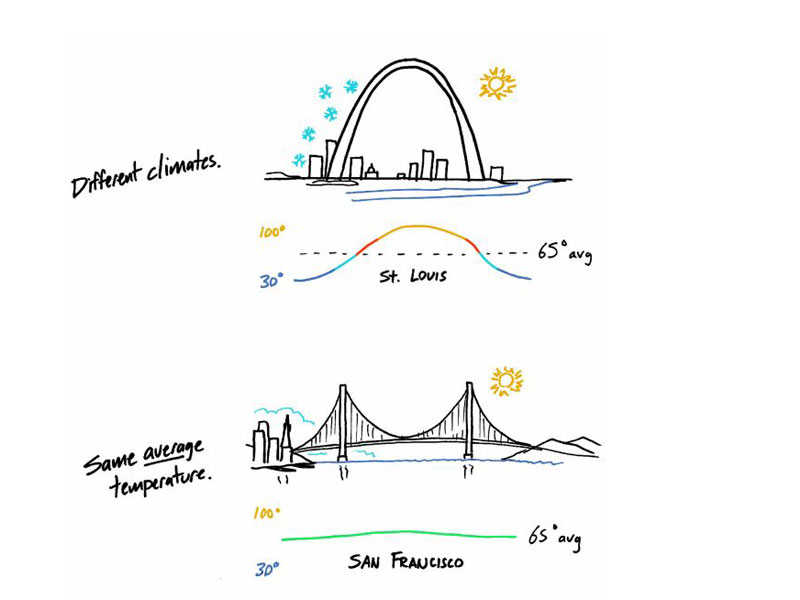

Diversification is the only free lunch in finance. Dr. Harry Markowitz, Nobel Laureate in Economics The Golden Gate Bridge in

It is not enough for a professional to be right: An advisor’s job is to be helpful. David H. Maister,

I abhor averages… A man may have six meals one day and none the next, making an average of three

It is a rough road that leads to the heights of greatness.Seneca, Philosopher Imagine there was electronic sign on your

Identity theft occurs when someone steals your personal information to commit fraud, such as fraudulently opening accounts, gaining access to

Did you know that 67 million people received Social Security benefits in 2017? Despite so many retirees relying on Social

Who is teaching your kids or grandkids about money? They likely aren’t learning about it in school; only 17 states

Retirement is one of the most important life events you will experience, and getting it right takes wise planning. With

Many investors are familiar with the emotional impact that often comes with market volatility. When stock markets swing in extreme

Did you achieve your financial goals in 2018? If not, keep reading. To achieve financial fitness this year, set strong

© Harrison Lazarus Advisors, Inc. All rights reserved. Built with Oechsli.